Reference News Network reported on September 13 Japanese media said that China accounted for 30% of the world's industrial robot sales, has become the largest market. Behind the fierce competition of robotic companies, the dominance of small precision reducers embedded in the joints of robotic arms has begun. In this area, Harmonic Drive Systems, the leading Japanese company, dominated the past, but now Chinese companies are rising. In addition, Nidec, a manufacturer of integrated motor motors, is also actively investing. Which of the three Chinese and Japanese companies can win the scuffle in the field of precision reducers?

According to the "Nihon Keizai Shimbun" website spin motor reported on September 12, in Guangdong Province, China, Huawei has a production base, and Taiwan's Hon Hai Precision Industry and other electronic products foundry (EMS) companies have also set up factories. While becoming a major producer of smartphones, Guangdong is one of the most competitive regions for small robots. In the robot market in Guangdong, there are not only large manufacturers in Japan and Europe, but also 40 or 50 local Chinese companies competing for market share.

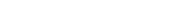

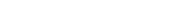

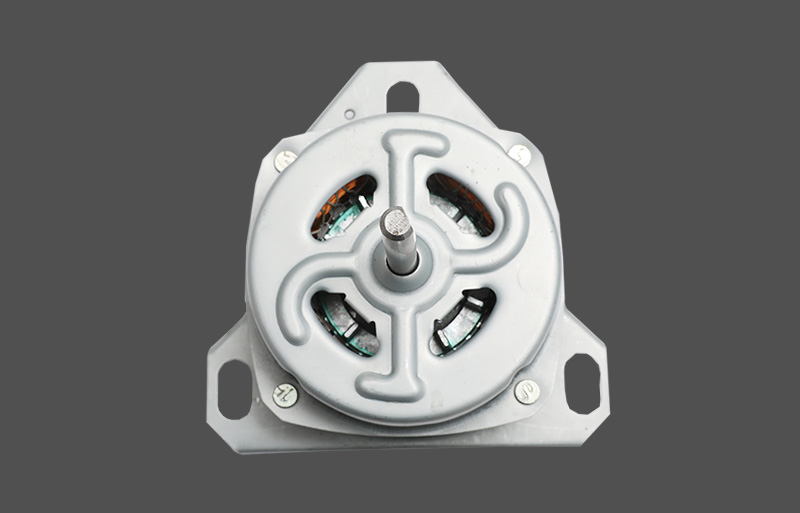

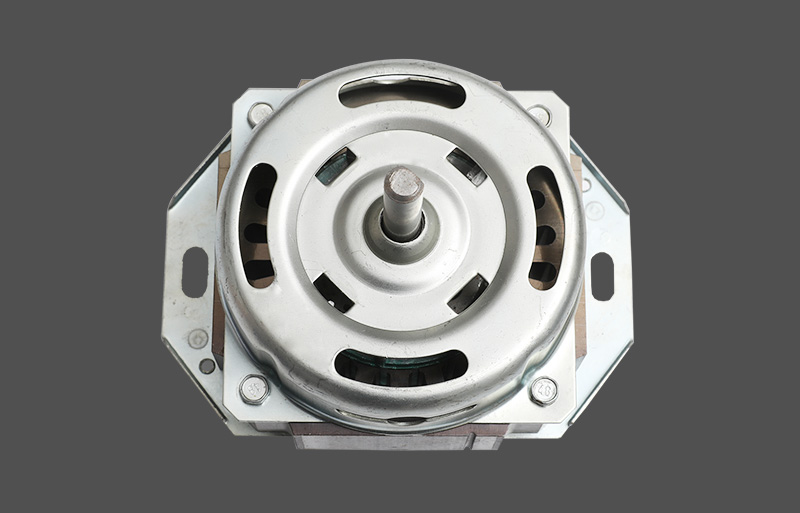

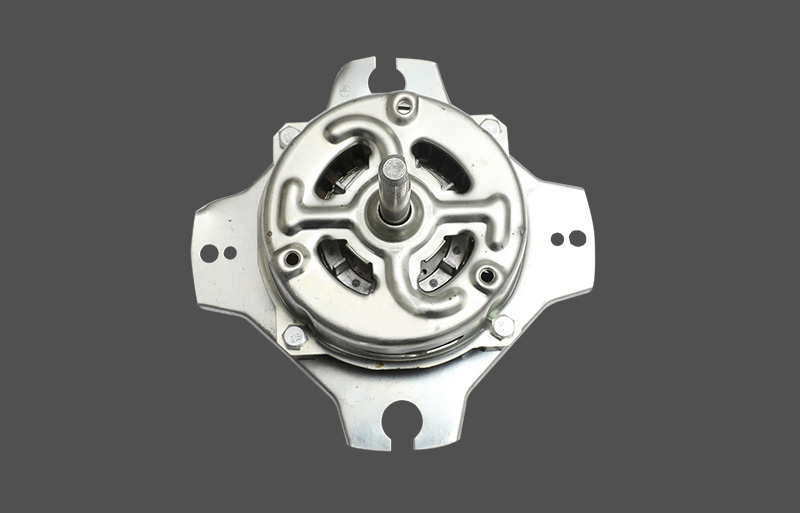

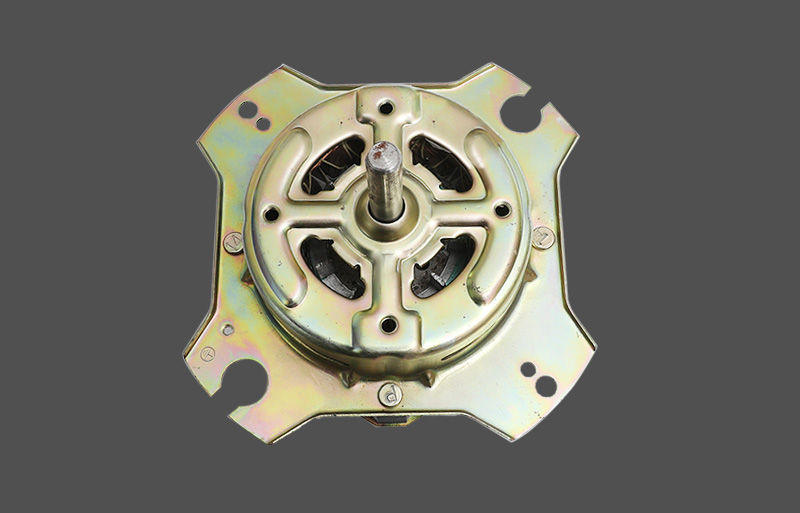

According to the report, behind the competition among industrial robot manufacturers, the battle for precision reducers that determine added value has become more intense. The reducer is a device that converts the rotation of the motor into a torque. It is mainly embedded in the joints of the arm, and can affect the accuracy, speed, and durability of the robot.

At present, the industrial robot industry is in excessive competition, and the low price based on mass production will determine the outcome. On the other hand, in the field of core components such as controllers, precision reducers, and motors for industrial robots, manufacturers can continuously increase the added value through the technical strength that other companies cannot imitate.

Especially in the field of small precision reducers, Japan's Hamernaco has maintained its leading position for many years and continued to supply exclusively as of 2000.

However, the current situation is changing, and environmental changes in China, the largest industrial robot market, have become the fuse.

According to the report, in China, the labor shortage has become more and more serious due to the increase in labor costs brought about by economic growth and the shortage of young people from manufacturing. Under this circumstance, the Chinese government issued the China Manufacturing Policy in 2015, indicating the promotion of the development of the industrial robot industry. Enterprises have begun to introduce industrial robots, and the demand for industrial robots in China is growing rapidly.

“The order for 2017 is three times that of the previous fiscal year, which is very rare.” The head of the Hamenaco Shenzhen office reviewed this overheating situation. It is said that Hamernaco's shipments have already met a large number of orders.

The report pointed out that at the same time, China is steadily promoting the policy of cultivating the industrial robot industry. In the field of reducers, China's Green Harmonic Drive Technology Co., Ltd. is on the rise and is expanding sales to industrial robot manufacturers in China. Japan's Hamernaco's calculations show that from the market share of small reducers for Chinese industrial robot manufacturers, Hamernaco is 40%, and green is 20%.

However, it is not only Chinese companies that aim at the gear unit. For example, Nidec, the world's No. 1 industrial motor manufacturer, has also launched an active investment in the reducer, announcing that it will invest 200 billion yen in mergers and acquisitions (M&A) and equipment investment through the subsidiary "Nippon Electric Power New Treasure" before 2022. .

According to the report, the International Robotics Federation issued an optimistic forecast that China will account for 40% of the world's industrial robot sales by 2020. The market for small precision reducers is in a three-pronged state, and the dominant competition seems to continue.